Binance Warns Of Crypto Market Risks From Overvaluation And Centralization Threats

A recent Binance report highlights the risks of overvaluation and centralized token ownership in the cryptocurrency market, warning that these issues could undermine long-term market stability. The report calls for more transparency and decentralized control to ensure sustainable growth.

The cryptocurrency industry is facing increasing risks due to overvaluation and the concentration of token ownership, according to a recent report by Binance. If these challenges are not addressed, they could potentially destabilize the market, raising concerns about the long-term sustainability of the crypto sector.

Online advertising service 1lx.online

A Binance spokesperson, speaking with Cointelegraph, emphasized the importance of responsible financial management and the need for decentralized control within the industry.

“Our report underscores the critical role of decentralized control and transparency in fund usage to foster long-term trust. Projects that adopt these principles are better positioned to gain market confidence and achieve sustainable growth,” said the spokesperson.

Valuation Concerns

The report from Binance revealed that inflated valuations, especially in newly launched tokens, can create a bubble effect, where demand fails to keep up with supply, leading to poor market performance.

This trend has been particularly evident as venture capital funds, which once aggressively poured into the crypto market, are now pulling back and shifting their focus toward sectors with safer and more reliable valuation practices.

“As more tokens are introduced with low circulating supplies, the supply of circulating tokens in the secondary market will increase exponentially over time, which could cause many tokens to suffer in terms of performance,” the report cautions.

Centralization Risks

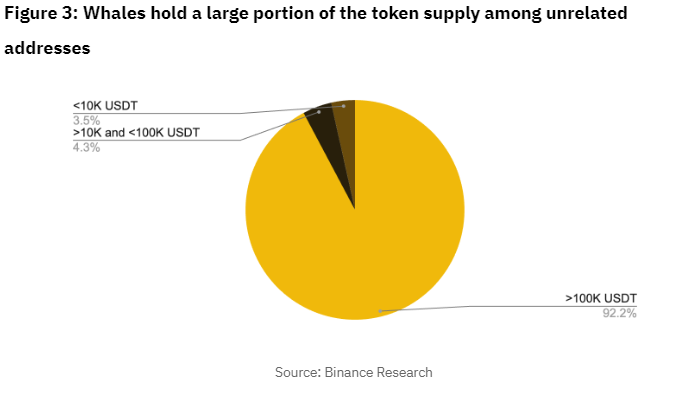

In addition to overvaluation, Binance pointed out the dangers of centralization in many crypto projects. When large portions of tokens are held by only a few investors, it can lead to governance issues, market manipulation, or sudden crashes triggered by large-scale sell-offs.

“The concentration of token ownership poses risks, including potential exploits […] ensuring decentralized control and broad participation is crucial for the integrity and resilience of crypto projects,” the report states.

Importance of Transparency

One of the key solutions highlighted in the Binance report is the need for greater transparency in how crypto projects manage their funds. The lack of transparency can erode stakeholder trust and ultimately damage the long-term sustainability of these projects.

“A lack of transparency in treasury management can erode stakeholder trust and cause long-term harm to project sustainability. Detailed disclosures can foster responsible financial management and build trust among stakeholders,” the report asserts.

With companies like Coinbase introducing proof-of-reserves, the industry is making strides toward greater transparency, which could help mitigate the risks raised in Binance’s report.

Notre créateur. Créez d'étonnantes collections NFT !

Soutenir la rédaction - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Binance gratuit 100 $ (exclusif): Utilisez ce lien pour vous inscrire et obtenir 100 $ gratuits et 10 % de réduction sur la commission Binance Futures pour les premiers mois

(Termes et conditions).

Bitget - Utilisez ce lien. Utilisez le centre de récompenses et gagnez jusqu'à 5 027 USDT !

(Revoir)

Inscription SANS RISQUE DE SANCTIONS sur l'échange Bybit: Utilisez ce lien toutes les réductions possibles sur les commissions et bonus jusqu'à 30 030 $ inclus) Si vous vous inscrivez via l'application, alors lors de l'inscription, entrez simplement dans le champ du lien : WB8XZ4 - (manuel)

Source – Traduit et publié ✓